Renewing surety bonds can seem like a daunting task, especially if this is your first time or you’ve faced challenges in the past. However, understanding the process and what to expect can make it a lot easier. This guide offers detailed tips, insights, and essential information to help you navigate your surety bond renewal successfully.

Understanding Surety Bonds

What Is a Surety Bond?

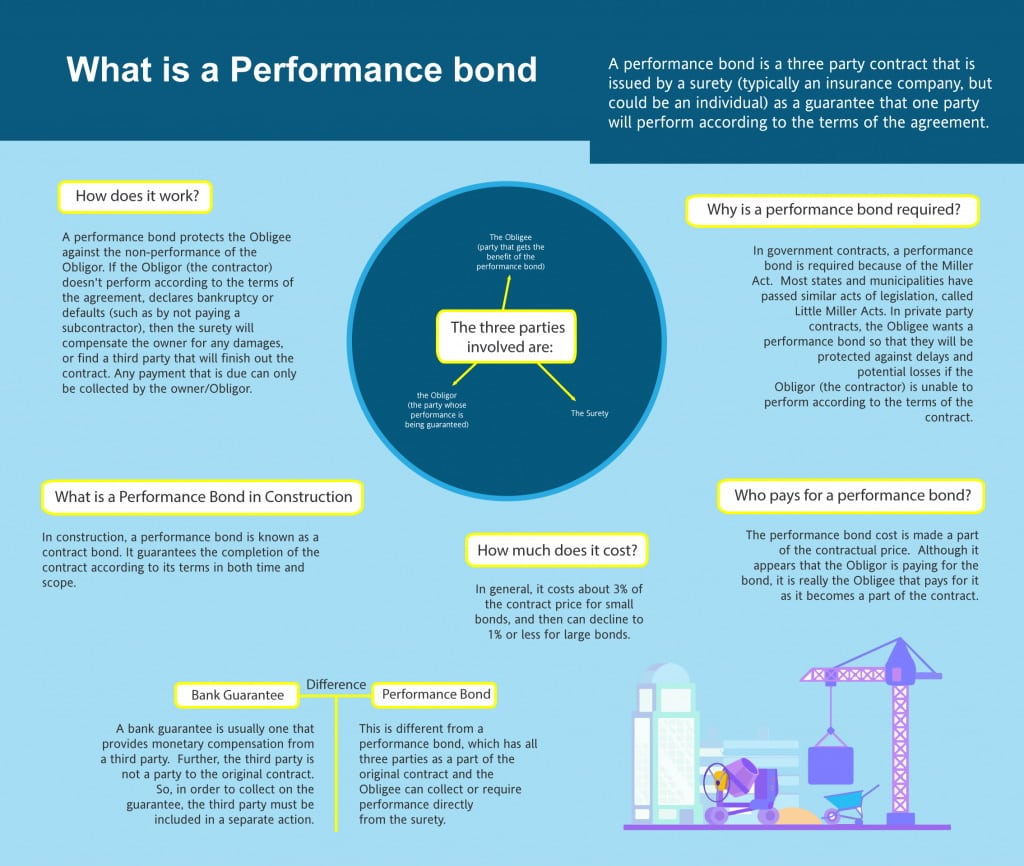

A surety bond is a three-party agreement that guarantees that one party will fulfill its obligations to another party. The parties involved are the principal (the person or business obtaining the bond), the obligee (the entity requiring the bond), and the surety (the company providing the bond).

Why Are Surety Bonds Important?

Surety bonds serve as an important risk management tool. They provide assurance that contractual obligations will be met, which can enhance your credibility in various industries. Additionally, they protect consumers from potential losses due to non-compliance by contractors or service providers.

The Renewal Process of Surety Bonds

When Should You Start Renewing Your Bond?

Typically, it's best to start the renewal process at how performance bonds work least 30-60 days before your current bond expires. This gives you ample time to gather necessary documentation and address any issues before your bond lapses.

Understanding Your Current Bond Terms

Before renewing your existing surety bonds, review the terms and conditions of your current bond. Understanding these details will help you identify any changes or updates needed for the renewal application.

Gathering Required Documentation for Renewal

Gather all necessary documents such as financial statements, credit reports, and any other information that may be required by the surety company. Having these on hand can expedite the renewal process.

Tips for Successfully Renewing Your Existing Surety Bonds

1. Maintain Strong Financial Health

Your financial standing plays a crucial role in getting bonded successfully. Ensure your financial statements reflect stability and growth over time.

2. Keep Your Credit Score Up

A good credit score can significantly impact your ability to renew bonds at favorable rates. If there are issues affecting your score, address them beforehand.

3. Communicate with Your Surety Agent

Maintaining an open line of communication with your surety agent can help you navigate any complexities in renewing your bond. Don’t hesitate to ask questions or seek clarification on any points of confusion.

4. Understand Changes in Risk Factors

Be aware of any changes in risk factors associated with your business since obtaining your original bond. For instance, expansions into new markets might require different coverage levels.

5. Review Past Performance Under the Bond

Analyzing how well you've adhered to contractual obligations under previous bonds can provide valuable insight into how you should approach renewal discussions with your surety provider.

6. Explore Multiple Sureties When Possible

Don't limit yourself to just one bonding company when looking for renewal options. Exploring multiple options can offer better rates and terms.

Common Challenges Faced During Renewal

Increased Premium Costs

One common challenge during renewal is facing increased premium costs due to market fluctuations or changes in risk assessment criteria.

Strategies to Mitigate Increased Costs

- Provide updated financial documentation. Showcase improvements made since last issuance. Consider bundling multiple bonds for better pricing.

Changes in Business Operations

If you've altered business operations significantly since obtaining your original bond, it may affect renewal eligibility or terms.

Addressing Operational Changes

Consider discussing any operational changes with a bonding professional who can advise on potential repercussions during renewal negotiations.

Frequently Asked Questions (FAQs)

1. What happens if I miss my surety bond renewal date? If you miss the expiration date, you may no longer be covered under the bond's protections until renewed; this could lead to legal complications depending on requirements set by obligees.

2. Can I renew my surety bond online? Yes! Many sureties offer online applications for renewals; however, ensure all documentation is submitted correctly.

3. How long does it typically take to renew a surety bond? The renewal process varies but generally takes anywhere from a few days up to several weeks depending on complexity and responsiveness from both parties involved.

4. Will my premiums increase upon renewal? Premiums may fluctuate based on several factors including financial health, claims history, and market conditions; it’s crucial to maintain strong records throughout the year.

5. Can I change my bonding company during renewal? Yes! You have every right to shop around for different bonding companies at renewal time; however, ensure new quotes align with industry standards for coverage types required by obligees.

6. What if my business has changed significantly since my last bond was issued? Informing your surety about significant changes allows them to reassess risks properly; this transparency helps establish trust moving forward into renewed agreements.

Conclusion: Mastering Surety Bond Renewals for Success

Successfully renewing existing surety bonds requires attention to detail and proactive engagement with both financial standing and communication channels within bonding companies. By maintaining strong finances, understanding changing risks, reviewing performance history comprehensively, and exploring multiple options when necessary—bondholders position themselves optimally for successful outcomes during renewals while ensuring compliance remains intact across all contractual obligations involved.

By following these "Tips for Successfully Renewing Your Existing Surety Bonds," you'll find that navigating this essential aspect of business becomes less daunting—and more manageable—over time!